On Thursday, Meta (formerly known as Facebook) experienced a nearly 8% surge in its shares as the company presented a promising revenue forecast that highlighted the significant impact of artificial intelligence (AI) on boosting engagement and ad sales, even amidst an uncertain economic climate.

The social media giant’s strong second-quarter earnings report impressed 18 analysts, leading them to raise their target price on Meta’s stock, which has already seen a remarkable year, more than doubling in value.

Mark Shmulik of Bernstein praised Meta, stating that the company is “in a class of their own in digital ads.” He further commented on the impressive guidance figures, which revealed an expected growth rate of +15-24%, surpassing investors’ expectations and creating considerable excitement for the future, possibly even as early as Q4.

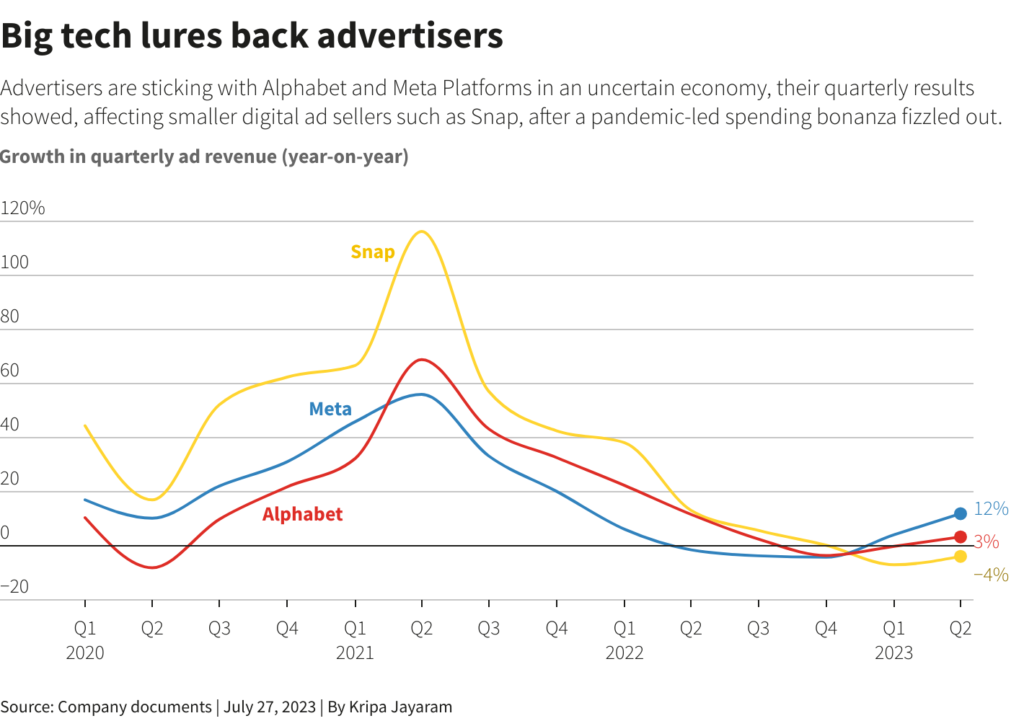

In the second quarter, Meta’s ad revenue soared by 12%, outpacing Alphabet’s Google, which reported 3% growth. These earnings reports from the two digital ad giants provided further evidence of a recovery in the sector. Together, Meta and Google are on track to add approximately $160 billion to their combined market capitalization, a figure exceeding the individual market values of about 90% of companies listed in the S&P 500 index.

However, the smaller rival Snap (SNAP.N) faced disappointment in its ad sales as advertisers remained loyal to established platforms, proving Meta’s dominance in the digital ad space.

Meta’s impressive results were also supported by the growing monetization of Reels, a short-form video format that competes with TikTok. CEO Mark Zuckerberg disclosed that Reels now boasts an annual revenue run rate exceeding $10 billion, an astonishing increase from $3 billion just last fall. Analyst Ali Mogharabi from Morningstar highlighted that Meta’s enhanced and AI-powered campaign planning and measurement capabilities are instilling confidence in advertisers, leading them to invest more in the platform. The continuous improvement in Reels monetization further contributes to the company’s success.

Meta’s strategic focus on cost-cutting measures and the implementation of AI to enhance user engagement has transformed the company into a Wall Street favorite this year. Previously criticized for its hefty spending on the ambitious metaverse concept in 2022, Meta has since proved its prowess in utilizing AI for business growth.

With a median price target of $355.50, analysts anticipate a 19% upside to Meta’s stock, based on its last closing price. The company’s 12-month forward price-to-earnings ratio of 21.28 is higher than Alphabet’s 20.47 and the industry median of 15.18.

The accelerated revenue growth at Meta has alleviated some concerns about potential higher expenses in 2024, attributed to legal fees and increased spending on infrastructure. These expenses are considered crucial for the tech sector’s ongoing AI race. Mark Mahaney of Evercore ISI acknowledged the uncertainty surrounding Meta’s CapEx spending growth for 2024 but also emphasized the numerous monetization opportunities that could arise from the company’s innovations.

Meta’s success story, powered by AI, indicates the immense potential of this technology in driving engagement, ad sales, and overall business growth in the digital realm. As the company continues to evolve, analysts and investors eagerly anticipate Meta’s future ventures in the dynamic tech landscape.