The heads of Samsung and SK Group, two of South Korea’s biggest conglomerates, are preparing for their upcoming trips to China amid the ongoing “chip war” and the US government’s efforts to restrain the growth of China’s chip industry.

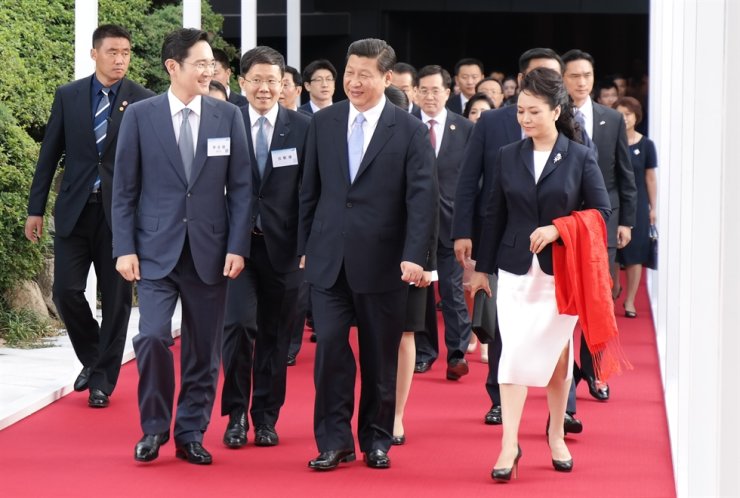

Samsung Electronics Chairman Lee Jae-Yong is expected to attend the China Development Forum (CDF) in Beijing, where he is likely to meet with high-ranking Chinese officials, including the country’s new Prime Minister Li Qiang, and discuss the development of the Chinese economy.

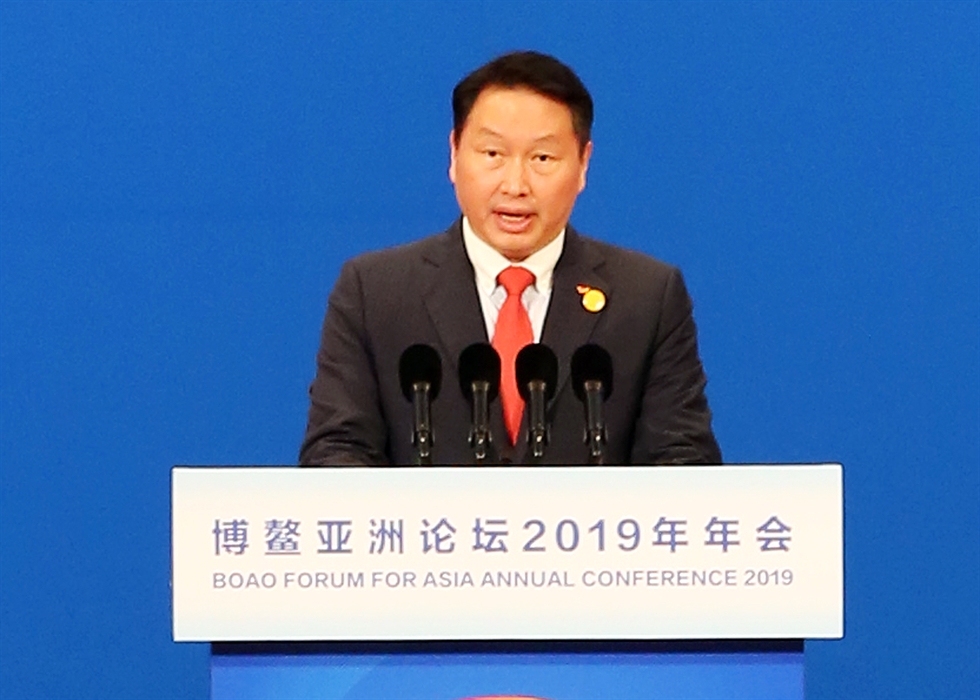

Meanwhile, SK Group and Korea Chamber of Commerce and Industry Chairman Chey Tae-won will attend the Boao Forum for Asia (BFA) in Hainan, China, where he is a council of advisers. These trips come at a time of heightened tensions in the semiconductor industry, as countries compete for dominance in the production and development of advanced chips.

As the U.S. government tightens its grip on the Chinese chip industry, the heads of Samsung and SK are preparing to visit China later this month. All eyes are on their semiconductor businesses and how they plan to overhaul them in the face of increasing pressure from the U.S.

Samsung Electronics Chairman Lee Jae-Yong is expected to participate in the China Development Forum (CDF) from March 25 to 27 in Beijing. The forum is held annually by the Chinese government to discuss ways to develop the country’s economy, and Lee is set to meet with high-ranking Chinese government officials during his visit.

He may also visit Samsung’s semiconductor factory in China, where he previously went to consider coping mechanisms for the U.S.-China trade war. During his visit to Japan last week, Lee emphasized the importance of having as many friends as possible and as few enemies as possible.

Meanwhile, SK Group and Korea Chamber of Commerce and Industry Chairman Chey Tae-won plans to attend the Boao Forum for Asia (BFA) in Hainan, China, from March 28 to 31. The chairman is among the BFA council of advisers, and during last year’s forum, he emphasized the importance of management in consideration of environmental, social, and corporate governance (ESG) principles.

It is uncertain whether Chey will also attend the CDF or visit SK Hynix’s factories in Wuxi and Dalian, according to an SK Group official. However, the same group of Korean business tycoons is expected to accompany President Yoon Suk Yeol on his forthcoming visit to the U.S. for the summit with U.S. President Joe Biden in April.

The trips by Samsung and SK to China come amid an escalating ‘chip war’ between the U.S. and China. The U.S. government has been putting increasing pressure on the Chinese chip industry, citing national security concerns. The visits by Lee and Chey will be closely watched by the industry as they explore ways to navigate this tense landscape.

The semiconductor industry has become a key battleground in the ongoing economic and technological competition between the U.S. and China. As the world’s two largest economies continue to vie for global dominance, both sides have been ramping up efforts to secure leadership in the semiconductor space.

For China, the semiconductor industry is seen as a key strategic priority in its drive to become a technological superpower. The Chinese government has been pouring billions of dollars into the industry, supporting domestic companies and investing in R&D in a bid to catch up with the likes of Samsung and Taiwan Semiconductor Manufacturing Company (TSMC).

The U.S. has been stepping up efforts to constrain China’s semiconductor industry, citing national security concerns. The U.S. government has placed sanctions on a number of Chinese companies, including Huawei and SMIC, limiting their ability to access American technology and components.

The U.S. has also been pushing for greater international cooperation in the semiconductor space, as it seeks to counter China’s rise in the industry. The Biden administration has proposed a $50 billion investment in semiconductor R&D, as well as calling for a global summit on semiconductor supply chains.

Against this backdrop, the visits by Samsung and SK to China take on added significance. As two of the world’s largest semiconductor companies, both firms have a lot at stake in the ongoing ‘chip war’. Their ability to navigate the complex geopolitical landscape will be critical in determining their future success in the industry.

For Samsung, the trip to China comes at a time when the company is looking to expand its global presence in the semiconductor space. Samsung is already the world’s largest manufacturer of memory chips, but it has been looking to diversify into other areas of the industry, such as foundry services.

The company has been investing heavily in its foundry business in recent years, with a particular focus on developing advanced process nodes. Samsung is expected to begin mass production of its 3nm process in 2022, which could put it ahead of TSMC in the race to develop the next generation of chips.

Samsung faces stiff competition from TSMC, which currently dominates the foundry market. TSMC is also investing heavily in advanced process nodes and recently announced plans to build a $12 billion chip plant in Arizona.

For SK, the trip to China comes at a time when the company is looking to expand its presence in the memory chip market. SK Hynix, the company’s semiconductor division, is the world’s third-largest manufacturer of memory chips, behind Samsung and Micron.

SK Hynix has been looking to increase its market share in the memory chip space and recently announced plans to build a new chip plant in South Korea. The company has also been investing in R&D, with a particular focus on developing new memory technologies such as HBM-PIM.

However, SK Hynix faces challenges from both Samsung and Chinese competitors such as Yangtze Memory Technologies. The Chinese company has been investing heavily in the memory chip space and has already begun mass production of its 64-layer 3D NAND flash memory.

In conclusion, the visits by Samsung and SK to China come at a critical time for the semiconductor industry. As the ‘chip war’ between the U.S. and China intensifies, both companies will be looking to navigate the complex geopolitical landscape and secure their future success in the industry.

The outcomes of their visits could have significant implications for the future of the semiconductor space and will be closely watched by industry insiders and analysts alike.