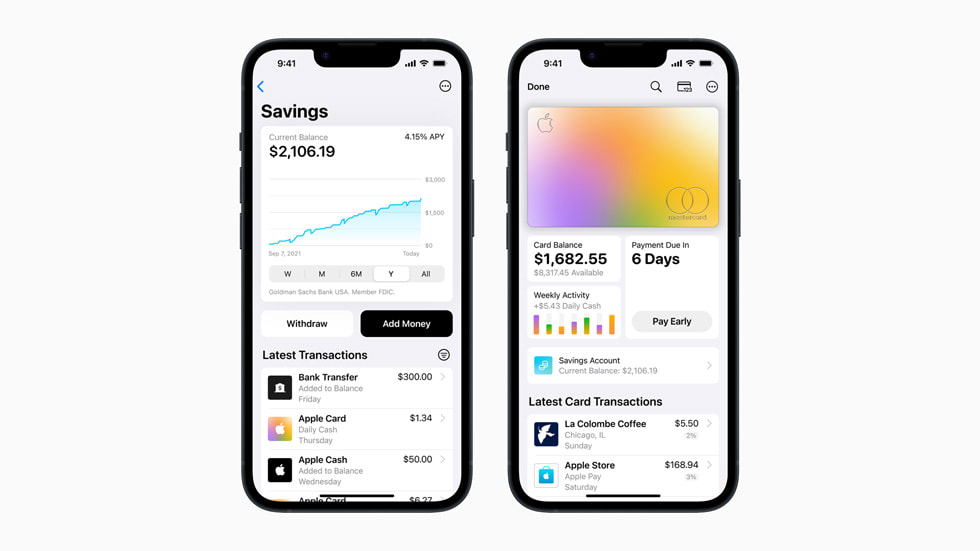

Apple just launched Apple Card Savings Accounts with a 4.15% annual percentage yield (APY). Starting today, U.S. Apple Card users will benefit from a new Savings account feature that provides a high-yield annual percentage yield (APY) of 4.15 percent, more than 10 times the national average.

This feature allows users to grow their Daily Cash rewards, the popular Apple Card benefit, by automatically depositing all future earnings into their Savings account.

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day.

said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet.

Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

The Savings account feature is available to all Apple Card users in the United States, making it accessible to millions of people. To start using the feature, users need to update their Wallet app to the latest version and follow the simple instructions to set up their Savings account.

With no fees, no minimum deposits, and no minimum balance requirements, users can easily set up and manage their Savings account directly from their Apple Card in the Wallet app. They can also change their Daily Cash destination and deposit additional funds into their Savings account through a linked bank account or Apple Cash balance.

Moreover, users can access an easy-to-use Savings dashboard in the Wallet app, where they can monitor their account balance and interest earned over time. They can also withdraw funds at any time through the Savings dashboard by transferring them to a linked bank account or their Apple Cash card, with no fees.

This new Savings account feature from Goldman Sachs complements the existing financial health benefits that Apple Card already provides, including no fees, Daily Cash on every purchase, and tools that encourage users to pay less interest on their Apple Card. All of these features are provided with the privacy and security that users expect from Apple.

Apple continues to prioritize its commitment to helping its users lead healthier financial lives. With the introduction of the Savings account feature, Apple Card users can take advantage of a high-yield APY with ease and convenience.

The introduction of the Savings account feature is a significant addition to Apple’s financial services ecosystem. It provides users with an innovative and straightforward method of saving money while also increasing their Daily Cash rewards.

Furthermore, the high-yield APY of 4.15 percent offered by Goldman Sachs is well above the national average, making it an attractive option for Apple Card users looking to save money.

In addition to the new Savings account feature, Apple Card offers numerous benefits that promote financial health, including Daily Cash rewards on every purchase, no fees, and tools that encourage users to pay less interest on their Apple Card balance.

Apple Card is also known for its exceptional security and privacy features, such as advanced security technology and no data sharing with third-party companies for advertising or marketing purposes.

Apple’s partnership with Goldman Sachs to provide a high-yield Savings account for Apple Card users is an excellent addition to the range of financial services offered by the company. The feature is easy to use, convenient, and secure, offering users an excellent opportunity to grow their savings while earning more Daily Cash rewards.