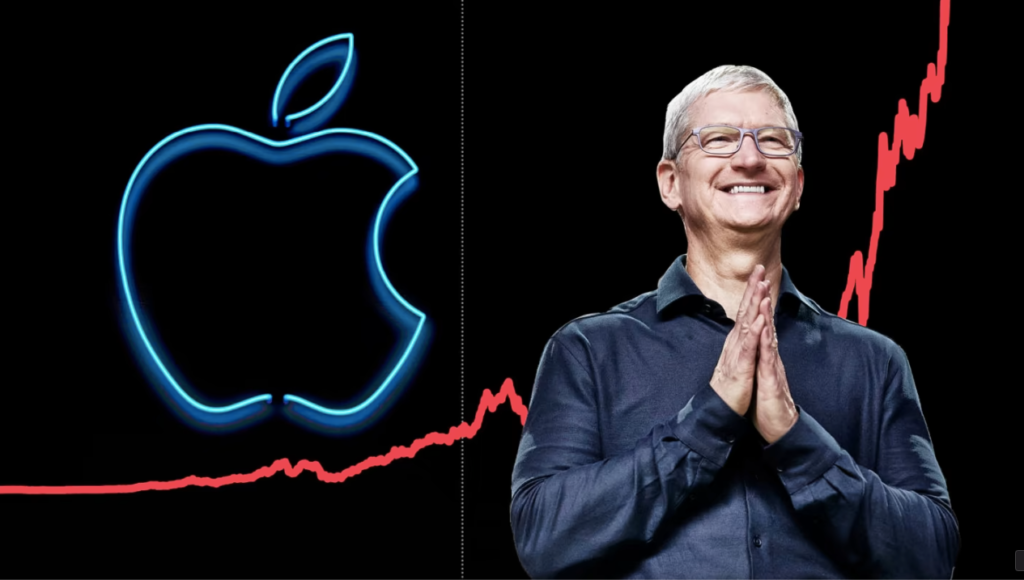

Apple’s high-yield savings account, launched on April 19, has drawn almost $1 billion in deposits in just four days, according to sources familiar with the matter. The savings account, offered in partnership with Goldman Sachs Bank USA, offers an annual return of 4.15%, significantly higher than the average bank rate of less than 0.5%.

On launch day alone, the savings account drew nearly $400 million in deposits, and by the end of the week, approximately 240,000 accounts had been opened. Experts attribute the high level of interest in the savings account to the attractive rate and the popularity of iPhones. With over 2 billion iPhone owners, the savings account’s integration with the iPhone and seamless user experience is a significant selling point for consumers.

The account is only available to holders of Apple’s credit cards, Apple Card, and clients can open a savings account in less than one minute directly from their iPhone. Daily cash rewards from the Apple Card are automatically directed into the high-yield account.

The savings account is entering a competitive market, as financial institutions struggle to attract and retain deposits following a series of bank failures. First Republic Bank is the latest financial institution to fail, with the bulk of its assets acquired by JPMorgan Chase, including $92 billion in deposits. In contrast, Goldman Sachs is rapidly pulling in consumer funds by tapping Apple’s massive iPhone user base.

The Apple savings account’s success may also be due to the lack of high-yield options available to savers. While banks have responded to the Fed’s interest rate hikes with higher mortgage and car loan rates, traditional bank deposits and savings accounts have seen little to no increase. As a result, many savers are turning to CDs, money market funds, and fintechs like Apple.

Although many traditional regional banks are struggling to maintain net interest margins, numerous digital banks and fintechs are offering higher yields. For example, Bask Bank offers a savings account with a 4.75% annual rate, while Neobanks Current, Varo, and LendingClub offer high-yield products with annual returns ranging from 2% to 4.25%. Nonetheless, Apple and Goldman’s seamless user experience and iPhone integration may give them the ultimate edge in the market.

As the banking industry continues to face challenges, with several institutions failing due to deposit outflows, Apple and Goldman Sachs seem to be tapping into a huge market of tech-savvy savers. The launch of the high-yield savings account is a part of Apple’s strategy to expand its services division and diversify its revenue streams beyond hardware sales.

While some industry experts believe that traditional banks may struggle to compete with Apple’s 4.15% interest rate, others argue that digital banks and fintech have been offering even higher yields. However, Apple’s unique advantage lies in its ability to provide a seamless user experience and integrate its financial services into the iPhone ecosystem.

The launch of the high-yield savings account is not the only financial service offered by Apple. The company has also introduced the Apple Card, a credit card that offers cashback rewards, and Apple Pay, a mobile payment system that allows users to make purchases using their iPhone or Apple Watch.

Overall, Apple’s foray into the financial services industry has been met with enthusiasm from savers looking for higher interest rates and a more modern banking experience. With the success of the high-yield savings account launch, it remains to be seen what other financial services Apple and Goldman Sachs will offer in the future.