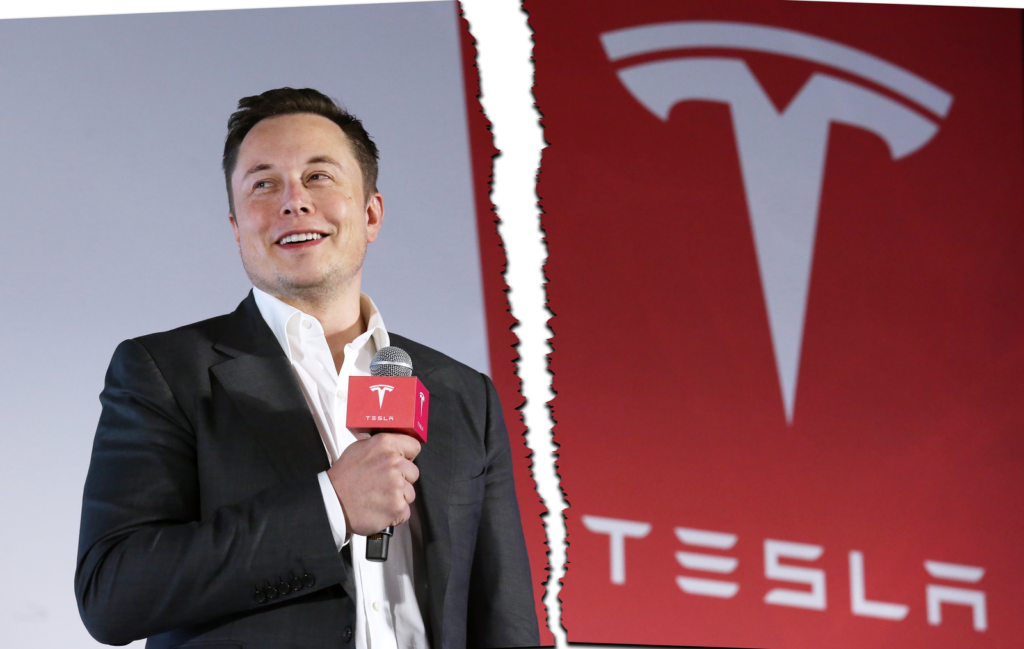

Elon Musk has refuted claims that the electric vehicle manufacturer Tesla is suffering as a result of his frequent usage of the social media site he owns, Twitter.

The car company released sales and profits for the period from October to December ahead of schedule.

Over the phone with investors,

Mr. Musk was asked if his “political influencing” on Twitter is hurting Tesla’s brand.

“I think Twitter is actually an incredibly powerful tool for driving demand for Tesla,” Mr. Musk said.

The 127 million people who follow him on social media, according to the billionaire who serves as Tesla’s CEO and product architect, “suggests that I’m quite popular.”

Following a tweet in 2018 suggesting he was thinking about taking Tesla private, Mr. Musk is currently involved in a legal dispute where he is accused of misleading investors. When a deal fell through, the firm’s share price rose briefly before dropping.

More recently, when he tweeted a peace plan to stop the Russia-Ukraine war, he sparked a backlash. One option was for Ukraine to hand over control of Crimea to Russia, which annexed it in 2014.

He told investors: “I would really encourage companies out there of all kinds, automotive or otherwise, to make more use of Twitter and to use their Twitter accounts in ways that are interesting and informative, entertaining, and it will help them drive sales just as it has with Tesla.”

Musk calls disputed Tesla tweet ‘right thing’ to do

Tesla’s share price fell by about two-thirds last year amid concerns that the business was losing its edge, while Mr. Musk was increasingly absorbed in his protracted $44 billion (£35.5 billion) buyout of Twitter and subsequent reorganization.

Tesla said on Wednesday that sales for the fourth quarter of 2022 increased 37% year on year to $24.3 billion. Revenues were predicted to increase by $24 billion.

Profits jumped 59% to $3.7 billion.

Commenting on the results, Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, said: “Elon Musk’s foray into social media leadership through the Twitter takeover has threatened to unpick a lot of confidence as investors fretted about Elon’s ability to lead both companies.”

She added that the court case was “another distraction”.

“The last thing serious investors want is to see their chief executive in a witness stand. The worst of the damage is done but there’s likely to be little room for error or sentiment roulette for some time,” she said.

Tesla sold a record-breaking 1.3 million vehicles to consumers overall, an increase of 40%.

Recently, the business lowered the cost of various vehicles, including the Model 3 and the least expensive Model Y. Some folks who had paid full price for the autos last year criticized it.

Mr. Musk admitted concerns about how a weaker economy and greater borrowing costs may affect the company.

However, he said that the price reductions are successful in luring customers, as orders have so far surpassed output this month.

“Price really matters,” he said. “We think demand will be good despite, probably, a contraction in the automotive market as a whole.”

Looking ahead, Mr. Musk said that he expected Tesla’s share price to recover over the long term, though warned that he anticipated a “pretty difficult recession” in 2023 which could lead to setbacks.

“There’s going to be bumps along the way and we’ll probably have a pretty difficult recession this year, probably,” he said. “I hope not, but probably.”