On Friday, Korea Economic Research Institute (KERI) identified four major issues with the subsidy requirements of the US CHIPS Act, which could impede the plans of chip companies to construct chip-making plants in the United States. These include the possibility of technology leaks, according to the Korea Economic Research Institute (KERI), a think tank under the Federation of Korean Industries (FKI).

One of the main issues is that the newly built factories’ chip facilities would be accessible, raising concerns over possible technology and trade secret leaks, as this is similar to granting access to national security agencies such as the Ministry of National Defense.

Samsung Electronics and other chip companies planning to establish manufacturing sites in the United States are becoming increasingly worried about the potential adverse effects on national security resulting from the onerous subsidy application requirements of the CHIPS and Science Act announced by the U.S. government.

The other issue raised by KERI is the sharing of excessive profits with the U.S. government. According to this requirement, chip companies receiving more than $150 million in subsidies must share up to 75% of the excess profits with the U.S. government, which could limit the profitability of investments and compromise the confidentiality of trade secrets.

KERI also raised concerns over submitting detailed accounting data to Washington and limiting the expansion of factories in China, which could negatively impact existing Chinese factories owned by Samsung and SK Hynix.

The guardrail provision that limits the expansion of factories in China may also adversely affect the productivity and profitability of current Chinese factories owned by Samsung and SK Hynix, which are considering constructing an advanced chip packaging plant in the U.S. Under the new restrictions, chip companies receiving subsidies in the U.S. are prohibited from expanding semiconductor production by more than 5% for advanced chips and 10% for older technology in China for ten years after receiving the benefits.

KERI urged cooperation between Korea and the U.S. to ease the subsidy requirements of the CHIPS Act, saying that it is necessary to establish semiconductor subsidy requirements based on reciprocity and fairness to promote mutual interests between Korean companies that are expanding investments in the U.S.

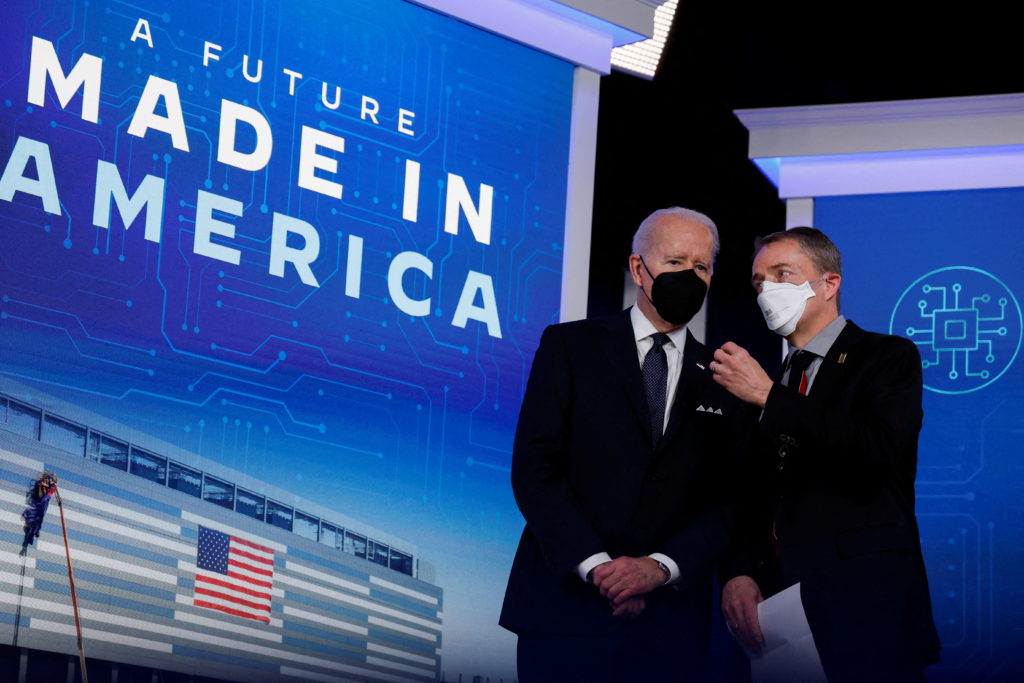

The U.S. Department of Commerce released details of the proposed “guardrails” for the CHIPS for America Incentives Program, which involves $52 billion in funding, given to firms to build new chip-making facilities, on March 21. President Yoon Suk Yeol is scheduled to visit the U.S. on April 26. Whether the concerns of the Korean chip industry can be addressed during the summit with President Joe Biden remains to be seen.

Despite increasing interest from chip companies in launching manufacturing sites in the United States, the potential negative impact on national security due to the excessive subsidy application requirements of the CHIPS and Science Act has raised concerns for Samsung Electronics and other companies, according to a think tank report by the Korea Economic Research Institute (KERI) on Friday.

The report highlighted four major issues with the subsidy requirements of the CHIPS Act, which could potentially hinder the plans of chip companies to build chip-making factories in the US. The issues include the allowance of access to chip facilities in newly built factories, the sharing of excessive profits with the US government, the submission of detailed accounting data with Washington, and the limitation of factory expansion in China.

KERI emphasized that the excessive subsidy requirements of the CHIPS Act could have a serious impact on semiconductor companies in Korea that are actively investing in the US. The report suggested that the relaxation of the subsidy requirements through cooperation between Korea and the US is necessary.

The CHIPS Act in Question

The CHIPS Act, which involves $52 billion in funding given to firms to build new chip-making facilities, released details of the proposed “guardrails” for the CHIPS for America Incentives Program on March 21. The Korea-U.S. summit, scheduled on April 26, is expected to discuss this issue.

KERI expressed concern over the potential leakage of technology and trade secrets if access to chip facilities is allowed, which could directly impact national security. Sharing excessive profits with the US government is also a concern, as it could negatively impact the profitability of investments and raise concerns about potential trade secret leakage when providing data on projected cash flows and rates of return on investments.

Additionally, the provision that limits the expansion of factories in China may negatively impact the productivity and profitability of existing Chinese factories owned by Samsung and SK Hynix, which is also considering building an advanced chip packaging plant in the US.

The new restrictions would ban chip companies that receive subsidies in the US from expanding semiconductor production by more than 5% for advanced chips and 10% for older technology in China for 10 years after receiving the benefits.

The KERI report concluded that it is necessary to establish semiconductor subsidy requirements based on reciprocity and fairness, in order to promote mutual interests between Korean companies that are expanding investments in the US.