Parents of FTX Founder are being accused of receiving millions of fraudulent transfers from the company before its collapse. Managers at the bankrupt firm have filed a lawsuit against the couple, alleging they held millions of “fraudulently transferred” dollars and turned a blind eye to misconduct within the company.

This legal action represents those seeking compensation following FTX’s failure, which ultimately led to Sam Bankman-Fried’s arrest last year. U.S. prosecutors have charged the former billionaire, once referred to as the “King of Crypto,” with illegally transferring millions from the exchange to cover losses at his trading firm, make political contributions, and purchase property. He has denied these allegations and is currently in custody, awaiting trial next month.

Attorneys representing Mr. Bankman-Fried’s parents vehemently deny the claims, asserting that they are “completely false” and intended to harm their son’s trial prospects.

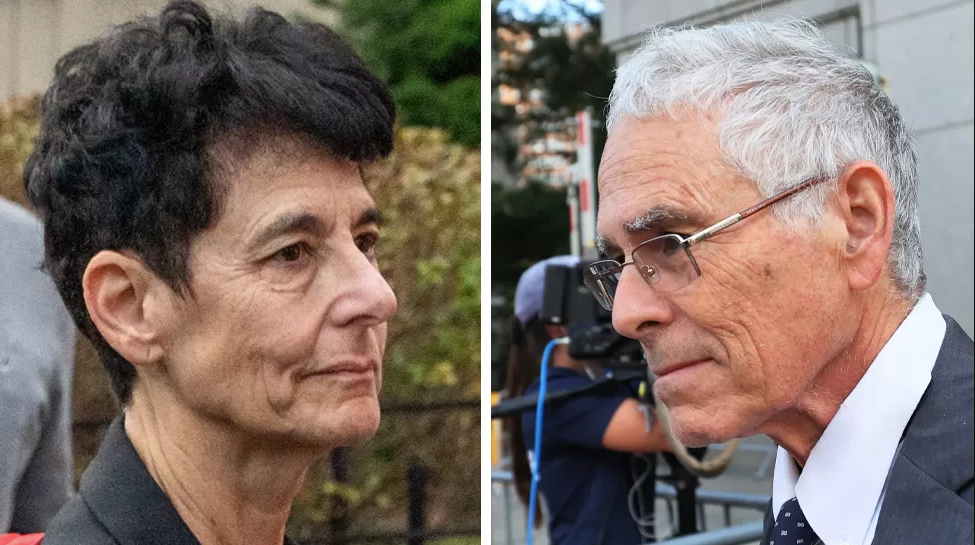

The lawsuit, filed as part of a broader bankruptcy case, alleges that Sam Bankman-Fried’s parents, both former professors at Stanford University, exploited their positions to enrich themselves, directly and indirectly, by millions of dollars.

Among the alleged improprieties, the couple received a $10 million cash gift from funds linked to Alameda, an FTX partner company. Additionally, FTX transferred a $16.4 million property in the Bahamas to them.

Once one of the world’s largest cryptocurrency trading firms, FTX had an estimated $15 billion in assets in 2021. However, it filed for bankruptcy last year after customers rushed to withdraw funds, revealing a significant financial shortfall, reportedly as much as $8 billion.

According to managers for the bankrupt firm, FTX was treated as a “piggy bank” by Mr. Bankman-Fried and other “insiders,” and his parents were accused of either perpetuating or benefiting from this alleged fraudulent behavior.

The lawsuit alleges that Mr. Bankman-Fried’s father, Allan Joseph Bankman, an expert in U.S. tax law, served as an adviser to FTX and played a pivotal role in maintaining a culture of misrepresentation, gross mismanagement, and covering up allegations that would have exposed the fraud. The suit also claims that he helped quash an internal complaint about price manipulation in 2019.

Mr. Bankman was allegedly treated to stays at hotels costing $1,200 per night. Messages cited in the lawsuit indicate that he complained about receiving a $200,000 salary, insisting it should be $1 million.

Meanwhile, Mr. Bankman-Fried’s mother, Barbara Fried, is alleged to have directed her son’s political donations, advising him on obscuring their source.

Managers for FTX are seeking to recover money from the couple. The fall of Sam Bankman-Fried, a prominent figure in the crypto industry, sent shockwaves through the sector and played a role in intensifying regulatory scrutiny.

Case Background from Kroll

On November 11, 2022, and November 14, 2022, FTX Trading Ltd. and 101 affiliated debtors (collectively, the “Debtors”) each filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware.

On February 13, 2023, an order was entered at Docket No. 711 dismissing the cases of Debtors SNG Investments Yatirim Ve Danismanlik Anonim Sirketi (Case No. 22-11093) and FTX Turkey Teknoloji Ve Ticaret Anonim Sirketi (Case No. 22-11170). On August 18, 2023, an order was entered at Docket No. 2207 dismissing the case of FTX Exchange FZE (Case No. 22-11100).

The remaining cases are pending before the Honorable John T. Dorsey and are jointly administered under Case No. 22-11068. Additional information regarding this matter can be found here.