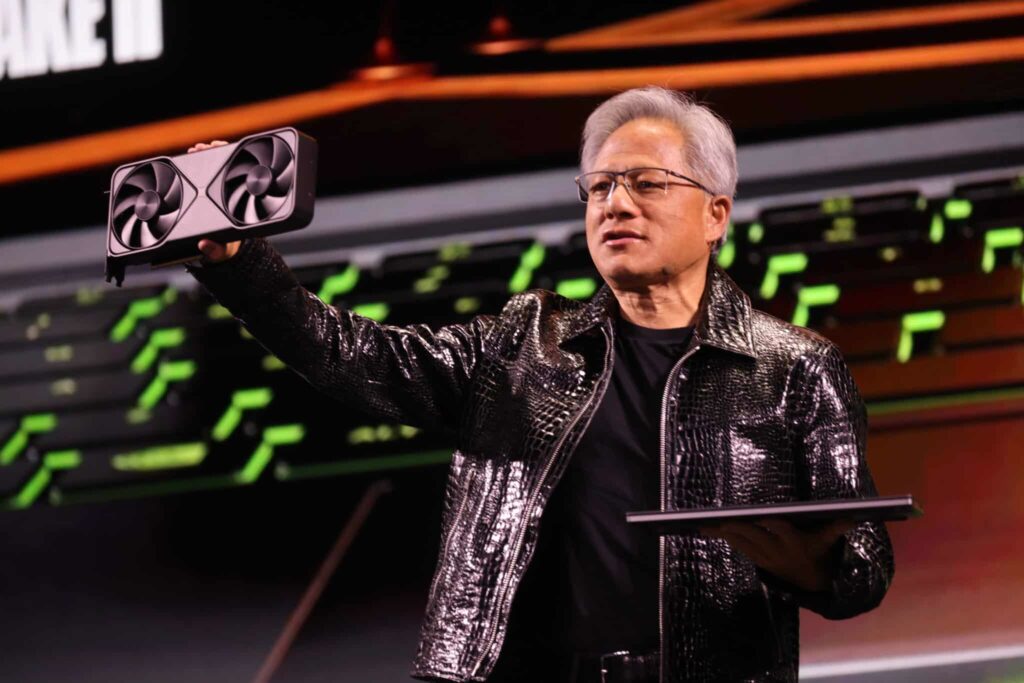

Quantum computing stocks experienced a sharp downturn on Wednesday, halting a year-long surge, after Nvidia CEO Jensen Huang tempered expectations about the practical viability of quantum technology. Huang’s remarks, highlighting a potential 20-year timeline for widespread use, shook investor confidence, leading to a significant selloff in the sector.

Huang’s statement at a recent tech event poured cold water on the hype surrounding quantum computing. “If you kind of said 15 years… that’d probably be on the early side. If you said 30, it’s probably on the late side. But if you picked 20, I think a whole bunch of us would believe it,” Huang remarked, setting a cautious tone for the future of quantum advancements.

This sobering projection contrasted sharply with the optimism that fuelled a threefold rise in quantum computing stocks last year. Companies like Rigetti Computing, D-Wave Quantum, Quantum Computing Inc., and IonQ saw their stock prices plummet by more than 40% following Huang’s comments. Collectively, the market value of these companies dropped by over $8 billion in a single trading session.

Hype vs. Reality: Revenue Challenges Persist

Despite their promise, quantum computing firms face significant challenges in generating meaningful revenue.

- IonQ, which boasted a valuation exceeding $10 billion earlier this week, is forecasted to earn just $41.6 million in fiscal 2024.

- Rigetti Computing, valued at $4.4 billion, is expected to generate annual revenue of only $11 million.

Investment analysts like Ivana Delevska of Spear Invest see the long development timeline as realistic. “The 15- to 20-year timeline seems very realistic. That is roughly what it took Nvidia to develop accelerated computing,” Delevska explained.

Quantum’s National Security Implications

Despite current limitations, quantum computing remains a critical area of focus for governments worldwide. The technology is viewed as a national security asset, with potential applications in military-grade encryption and decryption.

Analysts argue that while immediate revenues are modest, government contracts could provide a crucial lifeline. Craig-Hallum analyst Richard Shannon pointed out, “There will be considerable government-related revenues in the next few years. If investors are worried about minimal revenues that will require dilution, they are missing a key part of the equation.”

The Google Effect and Stock Market Euphoria

Last year’s rally in quantum stocks was fuelled by a high-profile breakthrough from Google, which demonstrated the potential of quantum supremacy. The announcement generated buzz around the technology’s disruptive capabilities, leading to speculative investments.

Quantum computing stocks outpaced even Nvidia, which saw its shares double during the same period. However, Huang’s recent remarks highlight the nascent stage of the sector, emphasising that real-world applications remain niche and largely experimental.

The Road Ahead: Disruption and Patience

Quantum computing holds the promise of revolutionizing industries ranging from cryptography to materials science, but the road to widespread adoption will require patience. Analysts like Shannon suggest that the technology could eventually disrupt the classical computing market, challenging even dominant players like Nvidia.

For now, the quantum computing sector must navigate a delicate balancing act: maintaining investor interest while managing the reality of a long development timeline.

Conclusion: A Dose of Reality for Quantum Enthusiasts

The dramatic fall in quantum computing stocks serves as a reminder of the gap between technological promise and commercial reality. While advancements continue to capture imaginations and government backing provides a steady funding stream, widespread practical use remains decades away.

Investors, experts, and tech enthusiasts must recalibrate expectations, recognising that quantum computing is a long-term play with potentially transformative but far-off impacts.