Tesla’s (TSLA) stock has been on a remarkable upward trajectory throughout 2023, outperforming the S&P 500 index by a wide margin. With shares surging 125% year to date and almost tripling since its 52-week low, investors are eager to know how much higher Tesla’s stock can climb. The luxury electric vehicle manufacturer is set to release its second-quarter fiscal 2023 financial results after the closing bell on Wednesday.

Tesla’s strong performance can be attributed to several factors, including record vehicle production and deliveries. In Q2, the company delivered an impressive 83% year-over-year increase, totaling 466,140 vehicles, which exceeded analysts’ estimates and marked Tesla’s largest delivery beat in nearly two years.

The recent deal with General Motors to allow drivers to use 12,000 Tesla superchargers via an adapter starting next year has further boosted investor confidence. Tesla’s charging port, compatible with the North American Charging Standard connector, will also support GM electric vehicles beginning in 2025. This partnership follows a similar agreement with Ford Motor. Analyst Daniel Ives of Wedbush views this deal as a significant win for Tesla, stating that the company has “cornered the market” and applauding CEO Elon Musk’s strategic moves.

While the positive developments have placed Tesla back on Ives’ Best Ideas list, there are factors to watch closely, such as the impact of recent price cuts on revenue, profits, and guidance for the second half of fiscal 2023. Analysts will also monitor Tesla’s average revenue per vehicle, profit margins, and customer deposits. The company’s segment financials will provide insight into its overall performance.

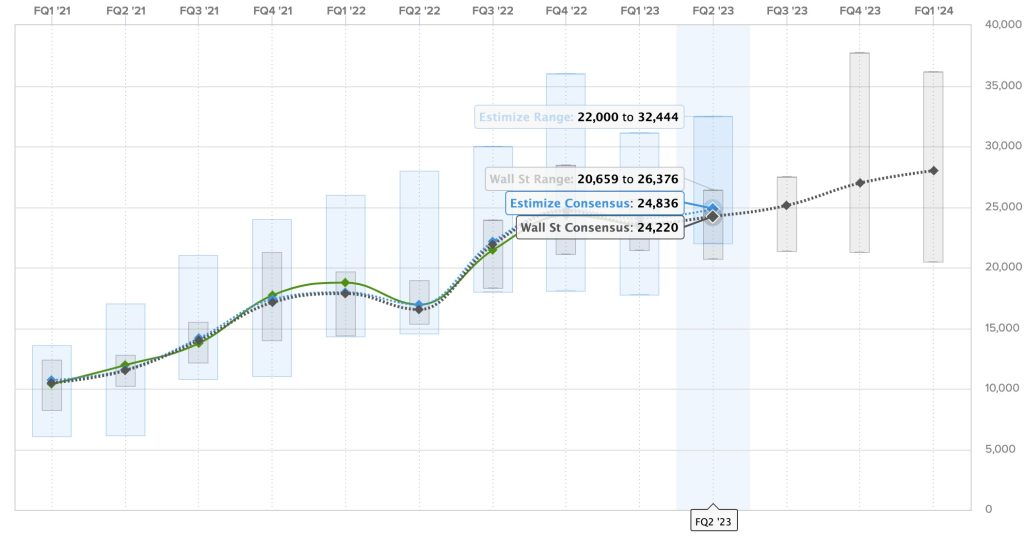

Wall Street analysts expect Tesla to report earnings of 81 cents per share on revenue of $24.53 billion for the June quarter, compared to earnings of 76 cents per share on revenue of $16.93 billion in the same period last year. However, full-year earnings for 2023 are projected to decline by 14% to $3.50 per share, while revenue is expected to rise by 23.2% to $100.34 billion compared to the previous year.

Tesla’s impressive vehicle production and delivery figures in the second quarter, along with its recent price cuts attracting new buyers, have fueled optimism. However, these price reductions are expected to exert pressure on revenue and profit margins. In Q1, the company fell short of expectations on both the top and bottom lines, reporting adjusted EPS of 85 cents on revenue of $23.3 billion.

Tesla’s continued rise in stock value hinges on its ability to surpass these figures and demonstrate improvement amid recent price cuts. The company’s innovative capabilities and cutting-edge technology have solidified its position as the dominant player in the electric vehicle market, which it essentially created. Investors will closely analyze Tesla’s financial results to gauge its future growth potential.

The upcoming release of Tesla’s second-quarter fiscal 2023 financial results will shed light on the company’s future growth potential. Tesla’s ability to innovate and deliver cutting-edge electric vehicles has propelled it to a position of dominance in the market. However, to sustain its stock’s upward trajectory, investors will closely scrutinize whether Tesla can improve on its numbers amid recent price cuts.

One of the key factors to watch in the financial results will be Tesla’s performance in revenue and profit margins. The recent price reductions may have attracted new buyers, resulting in record vehicle registrations. However, these price cuts are expected to put pressure on Tesla’s revenue and profit margins. Analysts will be keen to see if Tesla’s growth in vehicle deliveries and production can offset the impact of these reductions, maintaining healthy financials.

Additionally, investor attention will be drawn to Tesla’s ability to maintain its competitive edge and drive further innovation. The electric vehicle market is rapidly evolving, with new entrants and established automakers intensifying their efforts. Tesla’s ability to stay ahead of the competition through technological advancements and product differentiation will be crucial for its future success.

Beyond financial metrics, investors will also pay attention to Tesla’s outlook and guidance for the second half of fiscal 2023. As the company continues to expand its global footprint and explore new markets, its projections, and strategic initiatives will provide insights into its growth prospects. Tesla’s focus on vertical integration, energy storage, and autonomous driving technology will likely play a role in shaping its outlook.

Moreover, regulatory developments and government policies related to electric vehicles will impact Tesla’s future growth. The company’s ability to navigate evolving regulations and leverage incentives in various markets will be essential for sustaining its momentum.

Tesla’s strong performance in the second quarter, coupled with its recent partnerships with General Motors and Ford, suggests that the company is well-positioned for continued growth. However, challenges remain, including supply chain disruptions, global semiconductor shortages, and potential competition from both established automakers and emerging players.

As Tesla releases its financial results and provides insights into its future plans, investors will gauge the company’s ability to maintain its leadership position, navigate market dynamics, and drive sustainable growth. The outcome of these factors will undoubtedly shape the trajectory of Tesla’s stock and its standing in the electric vehicle industry.