|

Getting your Trinity Audio player ready...

|

Seurat Technologies, a pioneering 3D metal-printing startup, has dropped hints about a potential initial public offering (IPO) in the medium term while also revealing that it successfully raised $99 million in its latest funding round. The funding was co-led by the venture capital arm of chip designer Nvidia (NVDA.O.), NVentures, marking a significant milestone for the company.

As a result of the Series C funding round, an anonymous source disclosed that Seurat’s valuation is now on track to reach approximately $350 million.

CEO of Seurat Technologies, James DeMuth, expressed the company’s aspirations regarding going public. He stated, “I expect that going public is in our cards… 12–18 months is the earliest we would consider that… potentially more like 24 or 36.” DeMuth also noted that the proceeds from this funding round will be directed towards the deployment of the company’s production printers.

This recent fundraising endeavor saw the involvement of influential co-leaders, NVentures from Nvidia, and Capricorn’s Technology Impact Fund. Notably, Seurat welcomed new investors in the form of Honda Motor and Cubit Capital. Furthermore, existing backers, including Porsche and the venture capital divisions of Xerox Holdings and General Motors, enthusiastically participated in this round.

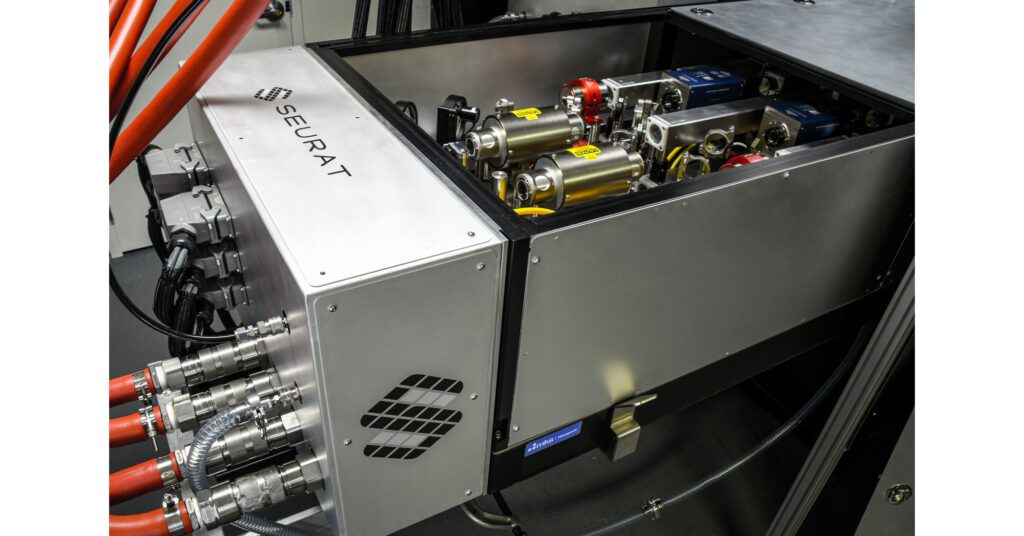

Seurat Technologies has a distinct focus on bringing parts manufacturing closer to customer factories worldwide, leveraging its green, energy-powered area printing technology. The company’s vision is to enable the reshoring of supply chains, thereby reducing emissions and enhancing sustainability.

In light of growing global concerns over supply chain resilience, companies across various industries have been actively seeking to diversify their supply chains and reduce their reliance on China. This trend has been driven by both business continuity considerations and escalating trade tensions between the United States and China.

Lutz Meschke, a board member of Porsche Automobil Holding and an existing investor, expressed his enthusiasm for Seurat’s approach, stating, “Seurat’s local factory deployment model provides the industry with a solution to near-shore manufacturing and increases the resiliency of supply chains.”

Seurat Technologies has already secured commitments to supply 59 tons of metal components for Siemens Energy’s turbines over a six-year period. Moreover, the startup recently revealed that it had received letters of intent from global manufacturers that exceeded the capacity of its pilot factory in Massachusetts.

The company’s impressive progress is underlined by its announcement that it holds letters of intent from six customers, totaling a substantial 4,000 tons of material. These developments position Seurat for the potential realization of $750 million in revenue over several years.

With its sights set on reshaping the manufacturing landscape and advancing sustainable practices, Seurat Technologies is poised to play a vital role in the evolving global supply chain dynamics, all while eyeing possible future growth through an IPO.