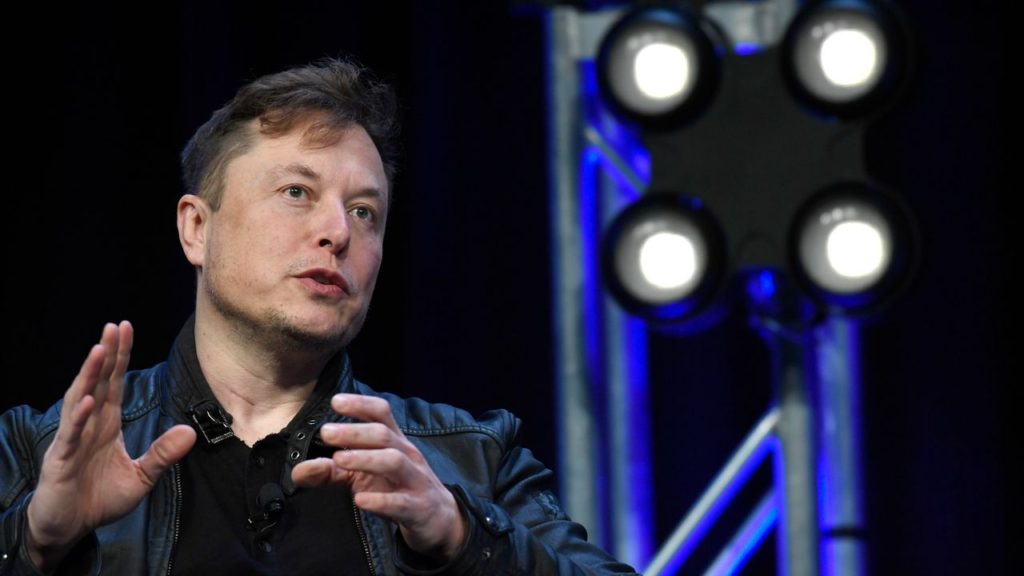

A U.S. judge has ruled that Elon Musk must confront most of a lawsuit accusing him of defrauding former Twitter shareholders by allegedly delaying the disclosure of his investment in the social media giant, which he later acquired and rebranded as “X.”

In a decision unveiled on Monday, U.S. District Judge Andrew Carter permitted shareholders involved in the proposed class action to proceed with their claims, arguing that Musk might have intended to defraud them by waiting 11 days beyond a U.S. Securities and Exchange Commission (SEC) deadline before revealing his acquisition of 5% of Twitter’s shares.

Judge Carter, sitting in Manhattan, did, however, dismiss an insider trading claim against Musk, who currently holds the title of the world’s wealthiest individual.

At the time of reporting, Musk’s legal representatives had not responded to requests for comment.

The lawsuit, led by an Oklahoma firefighter’s pension fund, alleges that Musk saved more than $200 million by progressively increasing his Twitter stake and engaging in secretive discussions with the company’s executives about his intentions, all before ultimately disclosing his 9.2% ownership in April 2022. Shareholders also assert that they sold their Twitter shares at artificially depressed prices due to Musk’s nondisclosure.

Musk’s defense maintained that their client’s failure to disclose was unintentional, emphasizing that he is “one of the busiest people on the planet.”

Judge Carter countered this argument, highlighting that Musk’s busy schedule did not justify noncompliance with SEC regulations when he found the time to acquire Twitter shares, meet with company executives, and discuss Twitter online.

The judge also noted that there was evidence indicating Musk’s familiarity with the 5% disclosure rule, including his previous testimony on the matter under oath. Additionally, Musk had correctly disclosed stakes in his electric vehicle company, Tesla, and the former SolarCity at least 20 times.

Katie Sinderson, an attorney representing the plaintiffs, declined to provide comments on the case.

Elon Musk’s acquisition of Twitter, finalized in October 2022, amounted to $44 billion. According to SEC rules, investors are required to disclose their acquisition of 5% or more of a company’s shares within ten days.

Upon Musk’s disclosure of his 9.2% stake in Twitter on April 4, 2022, Twitter’s shares surged by 27% to $49.97, up from $39.31, valuing the company at $54.20 per share.

The lawsuit is officially titled “Oklahoma Firefighters Pension and Retirement System v. Musk et al,” and it is being heard in the U.S. District Court for the Southern District of New York under case number 22-03026.