Investors of South Korea’s leading chip makers, Samsung Electronics and SK hynix, saw a sharp decline in their shares on Monday following Nvidia’s nearly 10 percent drop on Friday, marking its worst day since March 2020.

Shares of Samsung and SK hynix Dip

Both Samsung Electronics and SK hynix opened weaker compared to Friday’s closing. Samsung and SK hynix experienced declines of 1.93 percent and 0.98 percent, respectively, ending trading at 76,100 won ($55.14) and 171,600 won on the Kospi market. Despite the Kospi gaining 1.45 percent to close at 2,629.44 points, the shares of these chip giants suffered losses.

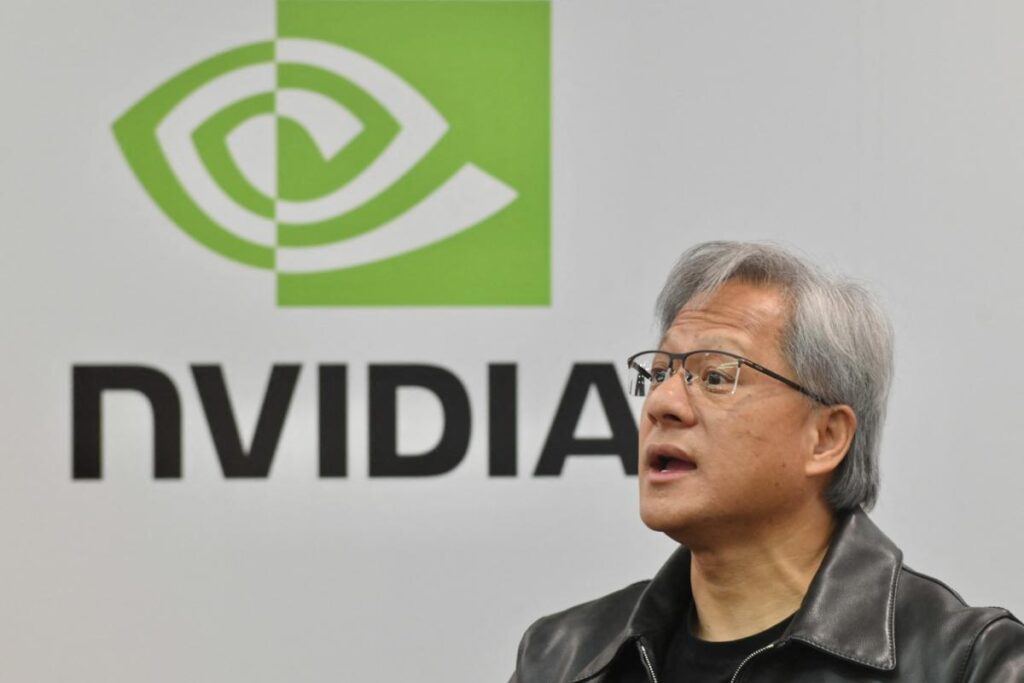

Nvidia’s Market Capitalization Plunge

Nvidia, the US chip giant, witnessed the second-worst daily loss of market capitalization for any US company ever on Friday, shedding about $2 trillion in market value in a single trading session. The price crash followed Taiwan Semiconductor Manufacturing Co.’s announcement of sluggish first-quarter earnings results. Nvidia, dominating around 80 percent of the global artificial intelligence chip market, relies heavily on TSMC for the manufacturing of its self-designed AI chips.

Bearish Moves in Nvidia’s Stock

Nvidia’s stock, which surged 95 percent this year, has recently displayed bearish trends due to concerns about the valuation burden from a short-term surge and worries about the AI bubble bursting. Market observers speculate that investors are also capitalizing on the rapidly rising technology stocks amid expectations of a base interest rate cut in the US and increased risks from tensions in the Middle East.

Investor Concerns and Market Outlook

Small investors’ apprehensions are growing after experiencing a bullish trend in the shares of the two Korean chipmakers, fueled by Nvidia’s rally. While Samsung and SK hynix shares reached their peaks recently, they have since declined. However, market experts view the current situation in the chip industry as an opportunity for investors to buy.

Analysts’ Perspective

According to Park Seung-young, an analyst at Hanwha Investment & Securities, the semiconductor industry is bottoming out, and performance is expected to improve in the coming months. Shin Seung-jin, an analyst at Samsung Securities, emphasizes the significance of first-quarter earnings announcements of global tech giants, including Samsung Electronics and SK hynix, in determining the direction of chip stocks.