Microsoft Corporation (MSFT), a giant in the Software & Programming industry, has received high marks from Validea’s guru fundamental report. Of the 22 investment strategies followed by Validea, Microsoft rates highest using the Patient Investor model based on the principles of Warren Buffett, one of the world’s most renowned investors.

Warren Buffett’s Patient Investor Strategy

The Patient Investor strategy seeks out firms with long-term, predictable profitability, low debt, and reasonable valuations. Microsoft scores an impressive 86% under this model, making it a stock of significant interest according to Buffett’s criteria. A score above 80% indicates substantial interest, while a score above 90% suggests strong interest.

Evaluation Criteria: Strengths and Weaknesses

The following table provides a brief overview of how Microsoft meets each of Buffett’s strategy tests. It highlights both the strengths and weak points of the stock in the context of this investment model. Not all criteria are equally weighted or independent, but the table serves as a useful summary.

Warren Buffett’s Investment Philosophy

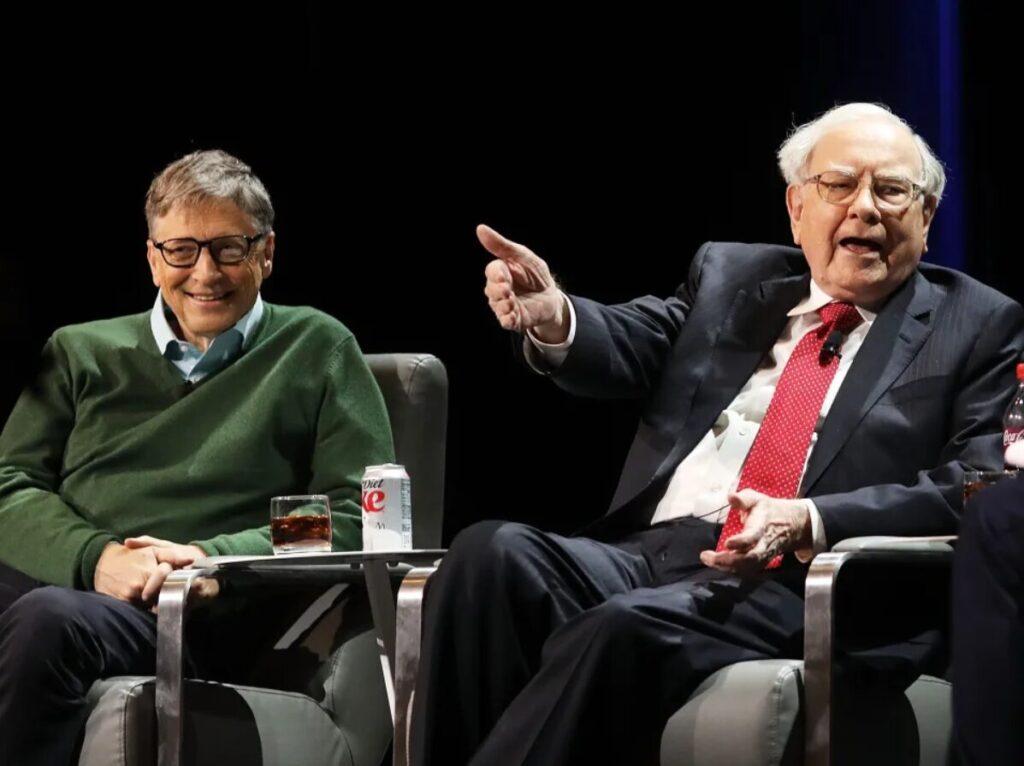

Warren Buffett, often regarded as the greatest investor of all time, has consistently outperformed the S&P 500 for decades as the chairman of Berkshire Hathaway. Forbes estimates his net worth at $37 billion, a testament to his investment acumen.

Despite his immense wealth, Buffett is known for his modest lifestyle. He continues to reside in the Nebraska home he purchased for $31,500 nearly 50 years ago and enjoys simple pleasures like cherry Coke, a good burger, and reading.

Microsoft’s Performance and Fundamentals

Microsoft’s high rating in the Patient Investor model underscores its strong fundamentals:

- Long-Term Profitability: Microsoft has demonstrated consistent profitability over the years, a key criterion for Buffett’s investment strategy.

- Low Debt Levels: The company maintains a manageable level of debt, ensuring financial stability and resilience.

- Reasonable Valuations: Despite being a large-cap growth stock, Microsoft trades at valuations deemed reasonable by the model.

Market Position and Growth Potential

As a leader in the technology sector, Microsoft continues to innovate and expand its market presence. Its diverse portfolio includes cloud computing (Azure), software products (Windows, Office), and hardware (Surface devices), positioning it well for sustained growth.

The company’s ability to adapt to changing market dynamics and its investment in cutting-edge technologies, such as artificial intelligence and quantum computing, further solidify its strong market position.

Conclusion: A Strong Investment Prospect

In conclusion, Microsoft’s high score in the Warren Buffett-inspired Patient Investor model highlights its strong investment potential. The company’s long-term profitability, low debt levels, and reasonable valuations make it an attractive option for investors seeking stable and predictable growth.

As Microsoft continues to lead in innovation and market presence, it remains a compelling choice for those following Buffett’s investment philosophy.

Additional Insights

While the Validea report provides a comprehensive analysis based on Buffett’s criteria, it is also essential to consider the broader market context and future growth opportunities. Microsoft’s ongoing investments in cloud computing, artificial intelligence, and other emerging technologies position it well for future success.

Moreover, the company’s robust financial health and strategic acquisitions further enhance its growth prospects, making it a strong contender in the tech industry. Investors looking for a reliable and high-performing stock may find Microsoft an appealing addition to their portfolios, aligning with Warren Buffett’s tried-and-true investment principles.