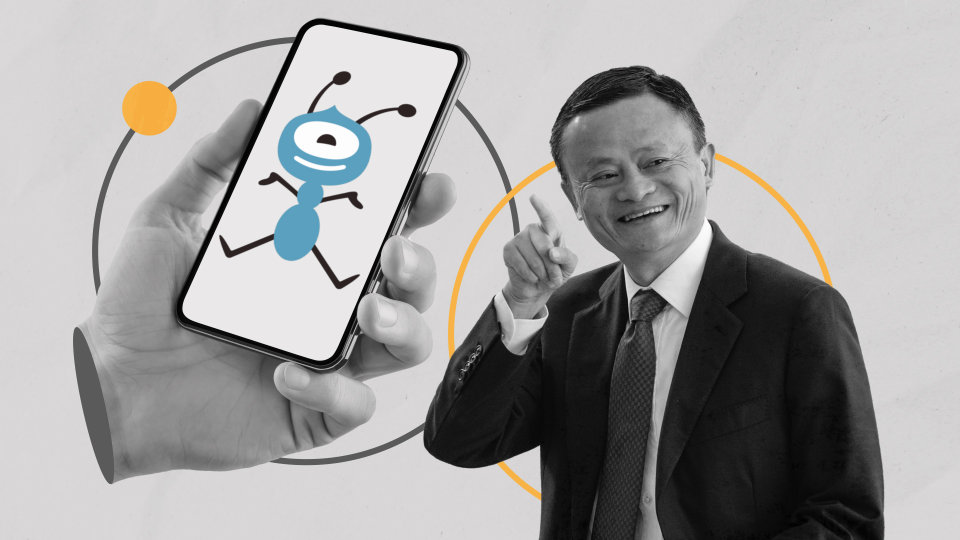

Shares of listed Chinese companies with Ant Group as a major shareholder rose on Monday following news that Ant founder Jack Ma is relinquishing control of the fintech behemoth following an overhaul.

Alibaba’s Hong Kong-listed shares increased by more than 5%.

Longshine Technology Group Co. Ltd., Jilin Zhengyuan, Shanghai Golden Bridge Infotech Co., Orbbec Inc., and Hundsun Technologies, all of which Ant owns more than 5% off, also increased in value.

Ant announced over the weekend that company founder Jack Ma will relinquish control of the company.

The overhaul aims to put an end to a regulatory crackdown that began shortly after its massive stock market debut was canceled two years ago.

“Investors can finally stop guessing and assign a risk premium to the new company that Ant was transformed into,” said Alexander Sirakov, managing partner at Shanghai-based investment consultancy Aquariusx.

While some analysts believe that relinquishing control could pave the way for the company’s IPO to be revived, the controller changes announced on Saturday are likely to result in a further delay due to listing regulations.

Companies must wait three years after a change in control before listing on China’s domestic A-share market. On Shanghai’s Nasdaq-style STAR market, the wait is two years, and in Hong Kong, it is one year.

Ant Group said on Sunday that it has no plans to go public.

Ant’s $37 billion IPO, which would have been the world’s largest, was canceled at the last minute in November 2020, forcing the financial technology firm to restructure and raising speculation that the Chinese billionaire would have to cede control.